India’s housing market has shown a sharp recovery from pre-pandemic lows and prospects for this segment looks very promising going forward. This positive sentiment is not only seen in consumers but even investors who are betting big on this recovery. More than a billion dollars of smart money was invested in this theme in 2021 (a 2.3x increase over 2020)

Recently, Apollo (a large global investment manager) indicated its intention to invest ~US$1Bn in this space after doing about ~US$750MM last year. Apollo directed two-third of this US$750MM investments into residential projects and is looking to continue its zest this year with ~70% of new allocation targeted towards home builders.

The inventory levels of unsold homes are at a 10-year low. Low home loan interest rates, covid-induced preference for home ownership, upgradation demand driven by preference towards spacious homes & community living are some of the drivers that sets the backdrop for a strong residential real estate cycle over the next few years in India.

Here are what the experts are saying:

“In over four and half decades, I have not seen a better time for the housing sector than now due to lower interest rates, stable property prices, government’s thrust on affordable housing, improved affordability, favorable demographics, increasing urbanisation and rising aspirations.”– Renu Sud Karnad, Managing Director, HDFC Ltd

“Customers and investors who had stayed away from residential real estate over the last 4 to 5 years are returning to the sector. Interest rates on housing loans are at an all-time low, thus creating affordable synergies in the market.” – Sharad Mittal, Director and CEO, Motilal Oswal Real Estate

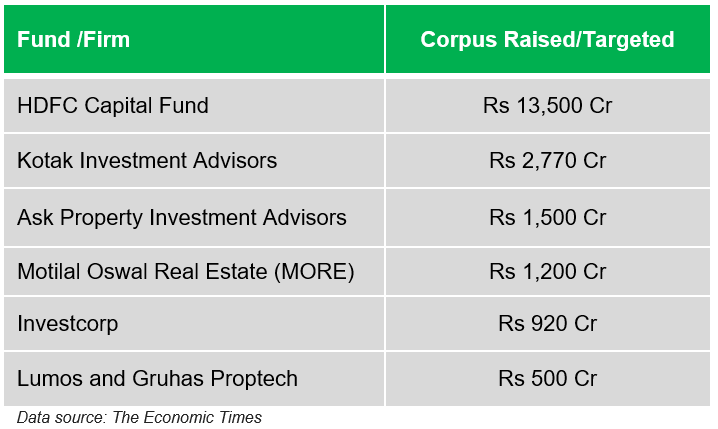

And this confidence is not only exhibited by global investors but also local investment institutions. Around 6 domestic private equity firms have raised, or are raising ~Rs.20,000cr. for investments in the real estate sector, largely in the residential segment. Here are some of the numbers: (Data Source: The Economic Times)