- Home

- Resources

- Bengaluru’s real estate market has been one of the most stable and resilient markets in India reaching new highs in CY24

Bengaluru’s real estate market has been one of the most stable and resilient markets in India reaching new highs in CY24

In a nutshell

1. Bengaluru, the startup capital and Silicon Valley of India, is a leading global technology hub.

2. Bengaluru real estate market is one of the most resilient markets in India with CY24 being the best year for Bengaluru’s residential and office market

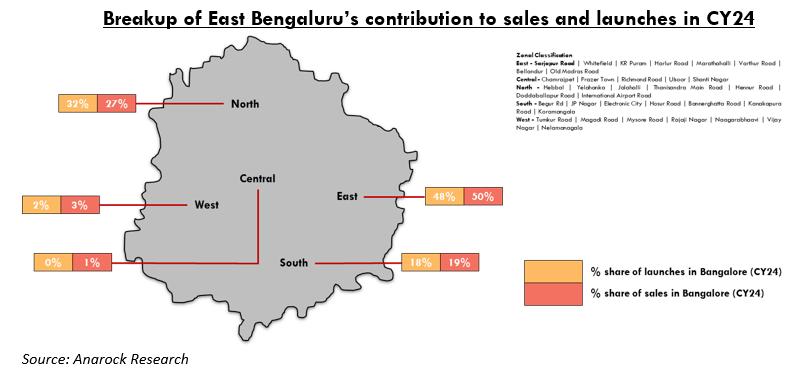

3. East Bengaluru was the largest micro-market contributing to 48% and 50% of launches and sales in Bangalore in CY24

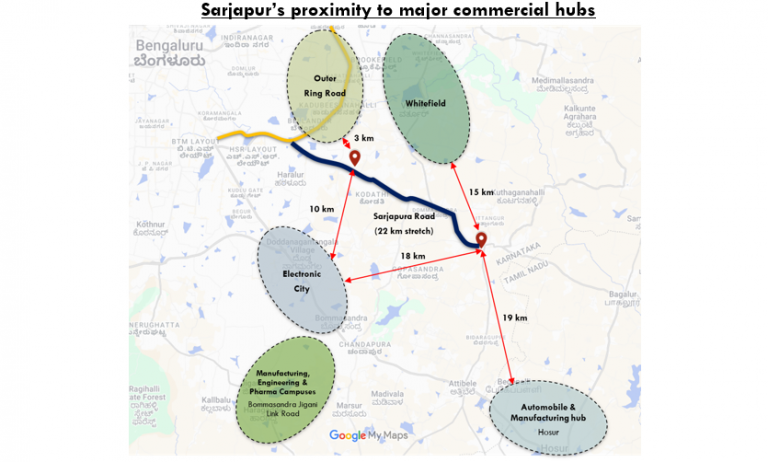

4. Sarjapura has emerged as a prime residential hub in Bengaluru with close proximity to major IT clusters like Whitefield, Electronic City and Outer Ring Road

Bengaluru’s rise as a global hub for innovation, technology, and entrepreneurship has fuelled an exponential demand for residential and office spaces

City at a glance

- Bengaluru, known as India’s ‘Silicon Valley’, has established itself as a global hub for innovation, technology, and entrepreneurship.

- Economy

- Bengaluru is expected to be one of the fastest growing cities in the world in the next decade, with a projected GDP growth of 8.5% until 2035.1

- IT/ITes sector (startup capital of India):

- Bengaluru is the startup capital of India.

- Largest technology base of Asia and 4th largest technological hub in the world.

- Ranked 21st amongst the Global Startup Ecosystem2, accounting for ~36% of unicorns in India.

- Home to the R&D centers of some of the world’s most prominent technology companies such as Google, Microsoft, Amazon, Nvidia, Qualcomm, Cisco etc.

- Home to 80%+ of India’s global IT offices2, accounts for ~42% of India’s total Global Capability Centers (GCCs) and contributes ~40% to India’s IT exports.1

- Aerospace and defence:

- Karnataka accounts for more than 65% of aerospace-related investments in India.1

- Bengaluru is home to the largest research and technology development centers for Airbus and Boeing, outside their home locations.

- Engineering and machine tools:

- Bengaluru produces 60% of the machine tools of India in terms of value.1

- There are six large and about 100 MSME machine tool units in the machine tool cluster in Bengaluru.

- Aerospace and defence:

- Human capital and quality of life

- Bengaluru has the 2nd highest employability rate of 72.46% in India. 1

- Bengaluru has the highest number of households earning more than a million INR per year, compared to other Tier 1 cities in India. The city comes second in average income per household.

- Bengaluru ranked 1st most millennial friendly city in India and 18th in Asia Pacific. 1

- Home to top-tier academic institutions such as Indian Institute of Science (IISc), Indian Institute of Management (IIM-B) and International Institute of Information Technology, Bangalore (IIIT-B).

- As per Mercer’s quality of living report 2024, Bengaluru ranks 3rd among other major cities in India.

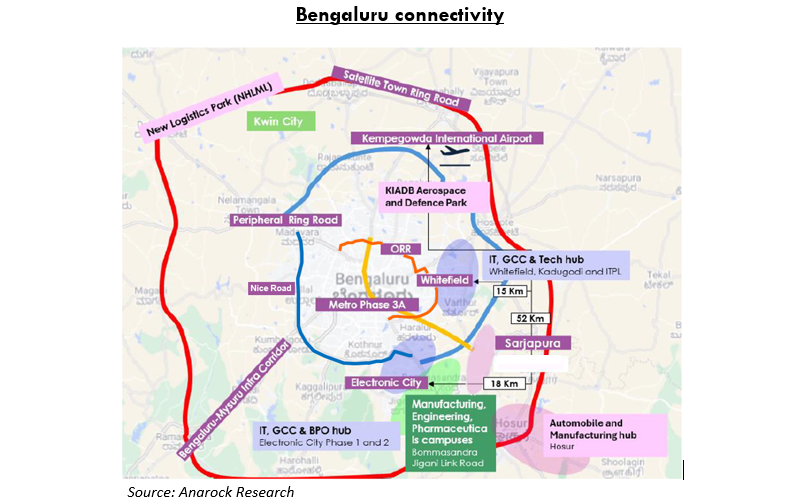

- Thrust on infrastructure

- City features well-designed infrastructure, including an extensive network of roads, flyovers, underpasses, ring roads and operating metro lines

- Bengaluru is undergoing a major infrastructure overhaul to improve urban mobility, reduce congestion, and enhance economic growth.

- State government has increased BBMP’s annual grant from INR 3,000 Cr to INR 7,000 Cr, with a special purpose vehicle (SPV) ensuring efficient project execution.

- Key projects include tunnel roads (INR 19,000 Cr), a 40.5 km double decker flyover (INR 8,916 Cr) and a 98.6 km metro expansion.3

Bengaluru real estate market:

- Bengaluru’s real estate market has been one of the most stable real estate markets in India buoyed by strong underlying economic fundamentals

- Driven largely by the end-users, the real estate market in the city has generally been very resilient even during the slowdown period.

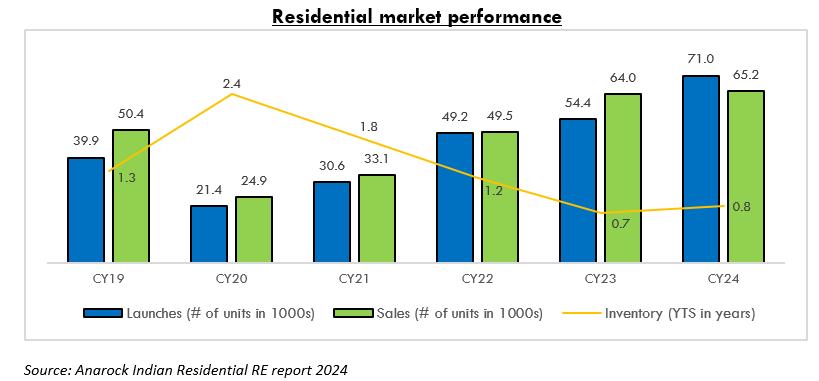

- Bengaluru’s residential market scaled a new peak in CY24, experiencing record-breaking launches and sales.

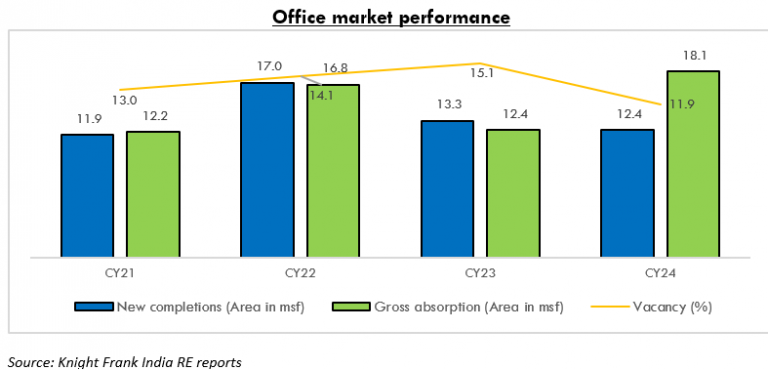

- Bengaluru’s demand for office space also has continued to surge since 2020, reaching an all-time high in 2024, highlighting the city’s continued attractiveness and thriving business environment.

- In CY24, Bengaluru recorded its highest gross absorption of office space, which was the highest among top 7 cities in India, contributing 26% of the total gross absorptions in the top 7 cities in CY24.

Bengaluru residential market:

- Bengaluru’s residential market demonstrated robust performance in CY24 scaling new peaks in terms of sales and launches:

- Bengaluru’s residential real estate market has witnessed continued growth momentum since CY20, witnessing 27% growth in sales and 35% CAGR growth in launches

- Expected time to liquidate unsold residential inventory in Bengaluru reduced from 2.4yrs in CY20 to 0.8yrs in CY24. YTS in Bengaluru has continually been the lowest compared to other top 6 cities since CY19

- In CY24, new launches grew significantly at 30% y-o-y while sales increased 2% y-o-y, indicating strong developer confidence in the market while maintaining healthy absorption levels.

- Number of properties registered temporarily dipped in second half of CY24 due to introduction of the mandatory e-khata system, however revenue from property registration improved in January 2025 with a 13% increase compared to January 2024.4

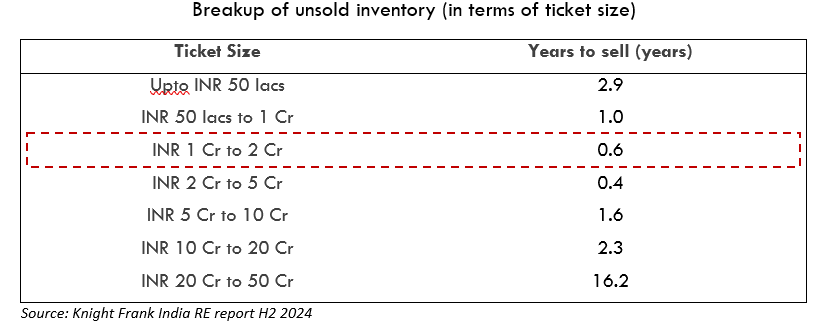

- Growing appetite for homes priced between INR 1.0 – 2.0 Cr shows Bengaluru’s maturing residential real estate landscape and evolving buyer demographics

- Bengaluru, traditionally a mid-segment market catering to IT-ITeS professionals, is witnessing a transformation with homes priced between INR 1.0 -2.0 Cr commanding a higher share in sales. This could be attributable to below factors:

- City’s thriving startup ecosystem has created a new generation of wealthy entrepreneurs and CXOs and strong growth in IT/ITeS sector has produced a larger pool of senior executives enhancing purchasing power

- Post-pandemic preference for larger, amenity-rich homes has accelerated the shift towards premium residences, with many mid-segment homeowners upgrading to luxury properties

- Inventory priced between INR 1-2 Cr is faster moving amongst the unsold inventory.

- Bengaluru, traditionally a mid-segment market catering to IT-ITeS professionals, is witnessing a transformation with homes priced between INR 1.0 -2.0 Cr commanding a higher share in sales. This could be attributable to below factors:

East Bengaluru micro-market:

- East Bengaluru was the largest micro-market in Bengaluru contributing c.48% and c.50% of the overall launches and sales in Bangalore in CY24.

- It is home to major IT-ITeS companies and startups in Whitefield and Outer Ring Road (ORR) and is easily accessibility to Kempegowda International Airport.

- Sarjapura Road, a 22 km stretch in East Bengaluru, has emerged as a thriving residential and commercial hub, transforming from an upcoming area to a key IT-ITeS corridor.

- Its strategic location offers excellent connectivity to major IT clusters like Whitefield, Electronic City, Outer Ring Road (Bellandur and Marathahalli), as well as proximity to Koramangala, HSR Layout, and BTM Layout.

- With 39,000 residential units launched from CY19 to CY24, Sarjapur accounts for ~30% of East Bengaluru’s residential supply.

- Sarjapur Road has experienced a 62% rise in property prices since 2018, fuelled by the announcement of various infrastructure projects.

- Upcoming infrastructure projects like the Namma Metro Yellow Line extension, Peripheral Ring Road (PRR), Satellite Town Ring Road (STRR), new IT parks, and a 647-acre industrial park are set to boost economic growth and real estate demand.

Bengaluru office market:

- Bengaluru’s dynamic economic environment, highly skilled workforce and continually improving infrastructure underscores its position as a premier destination for global and domestic businesses alike.

- In CY24, Bengaluru office market achieved a record-breaking performance, witnessing its highest-ever annual gross absorption volumes of 18.1 MM sf, contributing 26% to India’s top 7 cities’ total transactions.

- Global Capability Centers accounted for a significant portion of leasing activity as multinational corporations expanded their operations in Bengaluru, drawn by its established reputation as a technology hub and access to a highly skilled talent pool.

- Companies like Amazon, Bosch, and Walmart have reaffirmed the city’s status as a prime location for setting up innovation driven and large-scale operational centers.

- High gross absorption levels in the last 2 years has led to a decrease in the overall vacancy rate to 11.9% in CY24, demonstrating strong occupier demand.

(1) Years to sell (YTS) is calculated as the number of years to sell the unsold inventory considering the rolling 4-quarter average sales

References

- Source: Anarock

- Source: Startup Genome Report, https://startupgenome.com/articles/startup-genome-and-karnataka-digital-economy-mission-launch-the-worlds-most-comprehensive-research-on-startups

- Source: Propnewstime article, https://propnewstime.com/getdetailsStories/MTU4NzE=/bengaluru-real-estate-news-major-infrastructure-projects-to-drive-urban-transformation

- Source: The Hindu article, https://www.thehindu.com/news/cities/bangalore/revenue-from-property-registration-improves-in-january/article69101172.ece

- Source: Knight Frank report, HY 2024